Professional Resources For:

Bankers

Bankers

Help your customers access programs, services and other resources to improve their financial capability and economic mobility.

It is the goal of Money Smart KC to provide a resource database with a variety of tools for financial institutions in Metropolitan Kansas City. This resource database can be utilized as a training tool for new employees, a resource database for financial institution staff, a tool for planning CRA strategy, researching your assessment area and much more.

This tool also lists multiple resources to help bank the unbanked, a calendar of financial education classes and events, credit resources, mortgage resources, regulatory information, professional organizations and much more.

To list an event for free on the Money Smart KC website please click

Many Financial Institutions Partner With Money Smart KC

Money Smart Month of Greater Kansas City is a public awareness campaign designed to help consumers better manage their personal finances. This is achieved through the collaboration and coordinated effort of hundreds of organizations across the Kansas City Metropolitan area including businesses, financial institutions, schools, libraries, not-for-profits, government agencies and the media.

These groups come together to stress the importance of financial literacy, inform consumers about where they can get help, and provide free educational seminars, workshops and activities throughout the year. Since April is Financial Literacy Month, we have a special focus that month. Programming is offered to all ages and income levels and covers all areas of personal finance from establishing a budget to first time home buying to estate planning.

Since its inception in 2008, the initiative has grown exponentially. The 2015 Money Smart Month campaign hosted over 1,243 events (public and private) and reached a total of 18,121 attendee’s ages 5 – 85. Check out the Money Smart KC 2018 Playbook.

Ask the FFIEC a question: FFIEC

The FFIEC has an online opportunity for you to ask any question on consumer compliance, reports, financial institution information, examiner education, supervisory information, CRA, and much more.

Ask other bankers questions: Bankers Forum

We recommend that you ask your regulator any questions however, a banker’s forum is available at www.bankonline.com.

ABA, MBA and KBA

American Banking Association – Overview

- About ABA

- Training and Events

- Issues and Advocacy

- Compliance

- Tools and Resources

- Products

- ABA Foundation

Missouri Bankers Association – Overview

Kansas Bankers Association – Overview

Alliance for Economic Inclusion

The Kansas City Alliance for Economic Inclusion (AEI) consists of 650 individuals representing 350 organizations in a broad-based coalition of financial institutions, housing professionals, community-based organizations, businesses, schools and other partners in several markets across the Kansas City metro area. AEI focuses on bringing unbanked and underserved populations into the financial mainstream with an emphasis in creating financial resiliency for low- and moderate-income families in Metropolitan Kansas City. The AEI also works to expand affordable housing opportunities and mortgage credit for low- and moderate-income households.

Kansas City AEI seeks to expand basic retail financial service usage such as savings accounts, affordable remittance products, small-dollar loan programs, targeted financial education programs, alternative delivery channels and other asset-building programs. To further achieve AEI goals of helping the low- and moderate-income community, Kansas City AEI is working to increase banking services for minority and immigrant communities.

Cost or Obligation

The AEI has no cost or obligation to join. You will receive e-mail updates, invitations to AEI meetings and events and the ability to give input on multiple community initiatives that target low –and moderate-income families.

To join AEI Fill out form below:

FDIC: Affordable Mortgage Lending Center

Mortgage lending is an important element of many community banks’ business and Community Reinvestment Act (CRA) strategies. The FDIC’s Affordable Mortgage Lending Center is designed as a resource for community banks to help them compare a variety of current affordable mortgage programs and to identify the next steps if they seek to expand or initiate affordable mortgage lending. Offering affordable mortgage loans to a wide range of customers can deepen bank customer relationships and provide an important pathway for borrowers to own their own homes and participate in the mainstream banking system.

Bank Find

FDIC BankFind allows you to locate FDIC-insured banking institutions.

BANK On (CFE National Account Standards)

The updated Bank On National Account Standards, identify critical product features for appropriate bank or credit union accounts. Core account features include low costs, no overdraft fees, robust transaction capabilities such as a debit or prepaid card, and online bill pay. Notable changes in the 2017-2018 Standards include expanded allowable bill pay functionality: standard-meeting transaction accounts must either offer internal bill pay or instead provide consumers access to at least four free money orders or bank checks per month.

Download Bank On Comes To KC Press Release (PDF)

Download Spanish Version of Bank On Comes to KC Press Release (PDF)

Encourage a banking relationship or the benefits of banking

Visit the following Money Smart Topics for helpful information and links.

Banking 101

When managing your money, the right tools can make all the difference. Learn the basics of banking and be on your way to reach your financial goals.

Economic Mobility

Housing+Employment+Education/Training +Life Skills+Financial Literacy+Asset Development=Economic Mobility

Financial Coaching

Find financial education programs and services, as well as financial coaching in Metropolitan Kansas City.

Financial Education

Find out the resources available to obtain knowledge and an understanding of financial matters. Teaching tools, resources, activities, and more!

Financial Protection

Your personal information is a valuable commodity that needs to be protected. Find out how to protect you and your families information.

Financial Services

There are many financial institutions that can help you manage your money conveniently, while keeping your money safe.

Banking People with Disabilities

Visit the following Money Smart Topics for helpful information and links.

Banking 101

When managing your money, the right tools can make all the difference. Learn the basics of banking and be on your way to reach your financial goals.

Disability

Find links to local/national resources for those with disabilities. Learn about employment, transportation and more.

Youth Bank Accounts

Understanding the Law – This map is intended to provide state specific information regarding statutory requirements for the opening of bank accounts for minors.

FDIC – Youth Banking Resource Center – Through this website, learn about proven strategies to enhance youth financial education activities with access to a savings account.

Prosperity Now – Children Savings Programs- Information Systems Make Children’s Savings Programs Work. Here Are Three Things You Should Know About Them.

Visit the following Money Smart Teen Topic Page for helpful information and links.

Visit the following Money Smart Youth Topic Page for helpful information and links.

Broadband

Broadband Financing and Development

Bank Financing for Rural Broadband Initiatives Video: This brief OCC video highlights the important role that banks can play in helping rural communities develop high speed broadband systems and reviews how banks may receive CRA receive consideration for these activities. The video discusses how banks and community leaders developed a cooperatively-owned fiber optic network serving 10 towns and 17 townships across four counties in south central Minnesota.

Calendar of Financial Education Classes and Events

The Money Smart KC calendar is averaging 234 classes and events per month. All events are around the Kansas City area and they are Free or Low Cost!

Have an event coming up in the KC area that is Free or Low cost? Add Your event here!

CDFI/CDC

Community Development Financial Institutions Fund (CDFI)

Community Development Financial Institutions (CDFIS) share a common goal of expanding economic opportunity in low- income communities by providing access to financial products and services for local residents and businesses. Whether it’s the credit union down the street or a nearby small business loan fund, your community may be home to an organization known as a CDFI.

CDFIs can be banks, credit unions, loan funds, microloan funds, or venture capital providers. CDFIs are helping families finance their first homes, supporting community residents starting businesses, and investing in local health centers, schools, or community centers. CDFIs strive to foster economic opportunity and revitalize neighborhoods.

Community Development Corporation (CDC)

Community Development Corporations (CDCs) are nonprofit, community-based organizations focused on revitalizing the areas in which they are located, typically low-income, underserved neighborhoods that have experienced significant disinvestment. While they are most commonly celebrated for developing affordable housing, they are usually involved in a range of initiatives critical to community health such as economic development, sanitation, streetscaping, and neighborhood planning projects, and oftentimes even provide education and social services to neighborhood residents.

CDCs play a critical role in building community wealth for several key reasons:

- They anchor capital in communities by developing residential and commercial property, ranging from affordable housing to shopping centers and even businesses.

- At least one-third of a CDC’s board is typically composed of community residents, allowing for the possibility of direct, grass-roots participation in decision-making.

- CDCs’ work to enhance community conditions oftentimes involves neighborhood organizing, a process critical for empowering residents and gaining political power.

Census

- A source for updated population, housing, economic, and geographic data

- Find popular facts (population, income, etc.) and frequently requested data about your community.

Topics

- Population

- Economy

- Business

- Education

- Emergency Preparedness

- Employment

- Families & Living Arrangements

- Health

- Housing

- Income & Poverty

- International Trade

- Public Sector

Information on Metropolitan & Micropolitan Statistical Areas

- Lists of Metropolitan and Micropolitan Statistical Areas and definions

- OMB released updated delineations of metropolitan and micropolitan statistical areas in February 2013. For CRA purposes, banks will begin using the data January 1, 2014.

- Maps of metropolitan and micropolitan statistical areas

- The maps show metropolitan, micropolitan, and related statistical areas and their components at country, state, and town level.

- The American Community Survey (ACS)

- An ongoing survey that provides data every year — giving communities the current information they need to plan investments and services

- State & County Quick Facts

- Provides basic census data (population, median income, housing statistics, etc.) by state and county

Community Development

Federal Regulator Community Development

FDIC

Federal Reserve Bank

- Housing and Neighborhood Revitalization

- Small Business and Entrepreneurship

- Employment and Workforce Development

- Community Development Finance

- Understanding Community Development Needs through CRA Performance Context

Federal Reserve Bank of Kansas City

- Overview

- Community Development Investments

- Community Research

- Financial Health

- Small Business Development

- Strategic Partner Engagement

- Workforce Development

OCC

HUD Community Development Resources

HUD

State Community Development

Missouri

Kansas

Local Community Development

- Kansas City Missouri

- Kansas City Kansas

- Kansas City CDC’s

- Kansas City Housing Organizations

- Economic Development Corporation of Kansas City

Other Community Development Resources:

- Bank Enterprise Award Program

- (PDF) Community Developments Fact Sheet

- Bank Owned Community Development Corporations

- (PDF) Community Developments Fact Sheet

- CDFI Certification for National Banks and Federal Savings Associations

- (PDF) Community Developments Fact Sheet

- Community Development Corporations, Community Development Projects, and Other Public Welfare Investments Regulation

- (12 CFR 24) governs national bank investments designed to promote the public welfare. National banks may make investments in CD banks and CDFIs under the provisions outlined in the regulation.

- Community Development Loan Funds: Partnership Opportunities for Banks

- (PDF) (October 2014) This Insights report describes how partnerships between banks and community development loan funds, when structured and implemented appropriately, can help banks and CDLFs further their business and civic goals.

- Community Development Financial Institutions and CD Banks – Natural Partners for Traditional Lenders – OCC’s Summer 2002 Community Developments Newsletter

- This edition of the OCC’s Community Developments newsletter provides information on innovative and effective practices in the CD Bank and CDFI arenas. Articles by practitioners and experts give the reader an opportunity to see firsthand how CD Banks and CDFIs can reach underserved markets and individuals with financial services.

- Community Development Financial Institutions (CDFIs)

- Search for CDFI Fund award recipients

- Directory of non-profits

- Search for a list of non-profits by organization name, EIN, city, or state

- Guidance to Prospective Community Development Bank Organizing Groups

- (PDF) (2001) – This OCC memo provides a general discussion of the chartering process for community development national banks, including the licensing and operational issues facing bank organizers. It also outlines the criteria the OCC uses in granting a CD bank charter, explains the assistance OCC provides to organizers of CD banks, and states the factors the OCC considers to be critical to the success of any de novo CD bank. Please see our current list of nationally chartered CD banks (PDF).

- Guide To Tribal Ownership of a National Bank

- (PDF) (2002) – This guide was developed to assist federally recognized Indian tribes in exploring entry into the national banking system by establishing or acquiring control of a national bank. The publication provides a high level overview of the process of chartering a national bank and may also be useful to individuals and groups considering the formation of a Community Development Bank.

- HOME Investment Partnership Programs

- Low-income & community development credit unions

- Search for Low-Income Credit Unions by charter, city, state, or other criteria. Statute allowing investment by banks: NCUA Rule and Regulation #701.32 allows credit unions to recieve shares (which are deposits for credit unions), from non-members so long as they don’t exceed 20% of total shares in the credit union or $1.5MM, whichever is the larger.

- Minority-owned banks

- Investments in Minority Banks may qualify for CRA. Listing of minority institutions may be found here.

- Minority-Owned Banks – Making a Difference in Their Communities

- (Winter 2006-2007) – This Newsletter focuses on minority-owned institutions, the strategies they employ to serve their markets, and how majority-owned institutions can partner with minority-owned banks and receive consideration under the Community Reinvestment Act.

- Multi-Bank Partnerships for Community Development Financing

- (PDF) Community Developments Fact Sheet

- OCC Policy Statement on Minority-Owned Banks

- (PDF) (June 7, 2013) outlines the OCC’s policies and initiatives that facilitate the ability for minority banks to prosper and meet the needs of their communities.

- Reaching Minority Markets: Community Bank Strategies

- (PDF) (November 2006) – This edition of Insights examines strategies being used by community banks to target specific minority markets in the United States, the impact of these strategies on bringing unbanked consumers into the banking system, and some risks and regulatory considerations associated with each strategy.

Community Reinvestment Act

The Community Reinvestment Act is intended to encourage depository institutions to help meet the credit needs of the communities in which they operate, including low- and moderate-income neighborhoods, consistent with safe and sound operations.

The Community Reinvestment Act is intended to encourage depository institutions to help meet the credit needs of the communities in which they operate, including low- and moderate-income neighborhoods, consistent with safe and sound banking operations. It was enacted by the Congress in 1977 (12 U.S.C. 2901) and is implemented by Regulations 12 CFR parts 25, 228, 345, and 195.

The CRA requires that each insured depository institution’s record in helping meet the credit needs of its entire community be evaluated periodically. That record is taken into account in considering an institution’s application for deposit facilities, including mergers and acquisitions. CRA examinations are conducted by the federal agencies that are responsible for supervising depository institutions: the Board of Governors of the Federal Reserve System (FRB), the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC).

Conferences/Education/Training

National Organizations

Regulatory

- Consumer Financial Protection Bureau (CFPB)

- Federal Deposit Insurance Corporation (FDIC)

- Federal Financial Institution Examinations Council (FFIEC)

- Federal Reserve Bank (FRB)

- Federal Reserve Bank of Kansas City (FRB-KC)

- Office of the Comptroller of the Currency (OCC)

State Organizations

Kansas

Missouri

Understanding Credit

Visit the following Money Smart Topics for helpful information and links.

Banking 101

When managing your money, the right tools can make all the difference. Learn the basics of banking and be on your way to reach your financial goals.

Credit

Think of credit as a tool to be used wisely. Good credit saves money; bad credit costs money.

Credit Reports & Scores

It’s important to have a plan to build and maintain a good credit history. Learn the importance of credit reports and scores.

Financial Coaching

Find financial education programs and services, as well as financial coaching in Metropolitan Kansas City.

Designated Disaster Areas

FEMA– Total number of declared disasters: by State/Tribal Government and by Year.

Disaster Resources

HUD frequently asked questions 24/7

FHA Resource Center: answers@hud.gov.

FHA Call Center: 1-800-CALLFHA (1-800-225-5342). Persons with hearing or speech impairments may reach this number by calling the Federal Relay Service at 1-800-877-8339.

Disasterassistance.gov

This website will find help for end user immediate needs by entering an address to get a list of the closest FEMA Disaster Recovery Centers (DRCs), starting with the closest three. Contact your state’s emergency management agency to ask about other resources or to get your county’s contacts. Disasterassistance.gov also offers multiple other recovery help; Assistance Listings (formerly CFDA.gov), Benefits.gov, Grants.gov, HUD Grantees Information, Local Governments, State and Territory Governments, Tribal Governments, U.S. Government Services and Information, Community Development Resources, Community Recovery Management Toolkit, Multi-Agency Reunification Services Plan Template, National Resource Network, Post Disaster Reunification of Children – A Nationwide Approach, Rural Community Resources, Alternative Fueling Station Locator, U.S. Postal Service Alerts and Emergency Watershed Protection (EWP) Program

National Disaster Resources – Federal

CRA and Disaster Areas

US Economic Development Administration

Distressed/underserved non-MSA geographies

Distressed and Underserved Nonmetropolitan Middle-Income Geographies – Lists from 2005 – 2017

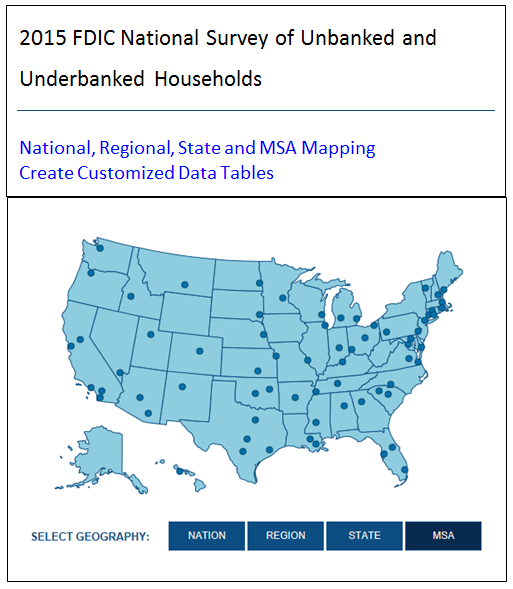

Unbanked/underbanked percentages – The 2015 FDIC National Survey of Unbanked and Underbanked Households presents new data and insights on the size of unbanked and underbanked markets at the national, regional, state, and large metropolitan statistical area (MSA) levels. This is the fourth installment of the report.

National Economic and Statistical Information

Large Aggregate Databases

- American Fact Finder – A source for updated population, housing, economic, and geographic data

- Data.gov – Data on multiple topics

- Economics and Statistical Administrations – Economic statistics

- Fedstats.gov – Provides access to statistics from more than 100 federal agencies. Perhaps most readily useful is the basic census data (population demographics, basic business demographics, etc.) that is available at the city, county and state level

- Prosperity Now Scorecard, a comprehensive resource for data on household financial health and policy recommendations to help put everyone in our country on a path to prosperity. Search Data by Location or by Issue.

Large Specific Subject Databases

- Bureau of Labor Statistics – National and regional resources for employment and business data

- Census Bureau – Economic Indicators

- Federal Bureau of Economic Analysis (BEA) Regional Facts (BEARFACTS) – Describes an area’s personal income, its sources and growth rates

- HUD – Housing Data

- National Center for Education Statistics – Education data

- Small Business Administration – Small business economic data

Regulator Economic Data

- CFPB

- FDIC

- Federal Reserve Bank

- Federal Reserve Bank of Kansas City

- FFIEC

- OCC

Local Economic Research

Bank Examinations

FFIEC link to agency examination schedules, annual asset threshold adjustments, list of distressed and undersevered nonmetropolitan middle-income geographies, examination procedures, and public evaluations

- FDIC link to examination procedures and other resources and information on CRA

- Federal Reserve link to the Consumer Compliance handbook

- OCC link to examination procedures and other resources and infomration on CRA

NOTE: Public Evaluation Templates and Instructions for Completing them – can be useful for conduction self-evaluations

Examination Overview:

Federal Regulators

FFIEC – Federal Financial Institutions Examination Council

FDIC – Federal Deposit Insurance Corporation

OCC – Office of the Comptroller of the Currency

FED – Federal Reserve

CFPB – Consumer Financial Protection Bureau

FTC – Federal Trade Commission

SEC – U.S. Securities and Exchange Commission

FEMA – Federal Emergency Management Agency

HUD – U.S. Department of Housing and Urban Development

Treasury – U.S. Department of the Treasury

FFIEC

The Council is a formal interagency body empowered to prescribe uniform principles, standards, and report forms for the federal examination of financial institutions by the Board of Governors of the Federal Reserve System (FRB), the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA), the Office of the Comptroller of the Currency (OCC), and the Consumer Financial Protection Bureau (CFPB), and to make recommendations to promote uniformity in the supervision of financial institutions.

Consumer Compliance

Consumer Help Center

Examiner Education

Financial institution Info

- UBPR

- UBPR User’s Guide

- FDIC Institution Directory

- CDR Information Site

Reports

Supervisory Info

- New National Information Center (NIC)

- National Info Center (NIC)

- BHC Reports

- BSA/AML InfoBase – (Bank Secrecy Act/Anti-Money Laundering)

- IT Handbook InfoBase

- Cybersecurity Awareness

- QIS-4

- Appraisal Subcommittee

- Guidance

Smart Spending

Visit the following Money Smart Topics for helpful information and links.

Budgeting/Smart Spending

Setting up a budget in advance will bring you financial freedom. Also finding discounts is the smart way to spend your money.

Financial Coaching

Find financial education programs and services, as well as financial coaching in Metropolitan Kansas City.

Financial Education

Find out the resources available to obtain knowledge and an understanding of financial matters. Teaching tools, resources, activities, and more!

HMDA

FFIEC – In this section of the website, you can find out more about the regulation and its interpretation.

CFPB – Resources to help industry understand, implement, and comply with the Home Mortgage Disclosure Act and Regulation C.

HUD

HUD Consolidated Plans

- Three-to-Five-Year Plans

- Analyses of the local housing market, and housing needs of low-income, homeless persons, and special needs populations

HUD Economic Development Programs

Other Useful HUD Links

- American Housing Survey

- Low-Income Housing Tax Credits

- Press Room

- Audiences

- State Info

- Program Offices

- Topic Areas

- Resources

Visit the following Money Smart Topics for helpful information and links.

Mapping

Map Your Community – Use our mapping tool to create custom maps of Tenth District communities, counties and states using key economic and demographic indicators.

Geocoding Tool – Enter a street address to find the MSA/MD, state, country, and census tract codes. – Click on the “Census Demographic Data” button for tract income level data.

Metropolitan Statistical Areas – Map metropolitan statistical areas.

FFIEC Geocoding System – The FFIEC Geocoding/Mapping System helps financial institutions meet legal requirements to report information on mortgage, business and farm loan applications.

FFIEC Distressed and Underserved Tracts – View an up-to-date listing of Distressed and Underserved Tracts.

National Center for Education Statistics

- Get information about free and reduced lunches. For additional details, read the FFIEC’s Q&As.

- Metropolitan Statistical Areas (including maps): https://www.census.gov/population/metro/

Policy Map – Easy-to-use online mapping with data on demographics, real estate, health, jobs and more in communities across the US.

Rural Mapping – USDA Agricultural Data.

Prosperity Now Scorecard, a comprehensive resource for data on household financial health and policy recommendations to help put everyone in our country on a path to prosperity. Search Data by Location or by Issue.

The Enterprise Opportunity Zone Mapping Tool has been updated to include final designations in all states and the District of Columbia. The Opportunity360 team created the mapping tool to help stakeholders determine which tracts have been designated as Opportunity Zones and what other federal programs and designations are in effect in those areas. In addition, users can filter tracts using the Opportunity360 Outcome Indices to see how people living in these tracts are faring across our five outcome dimensions, as well explore eligible tracts that were not designated as Opportunity Zones. Visit our Opportunity Zones webpage for information and updates on the tax incentive.

FDIC – Market Share of Deposits

The Deposit Market Share is the percentage of deposits an FDIC-insured institution has within a defined geographic market. This data is based on the annual Summary of Deposits (SOD) survey for FDIC-insured institutions as of June 30.

The Deposit Market Share and the Pro Forma (HHI) Reports provide information for all institutions within a specific geographic market for a specific time period. The Market Presence and Growth Rate Reports provide similar information, but from the perspective of one institution. All reports provide data back to 1994 and are available by institution or bank holding company.

Deposit Market Share – The Deposit Market Share Report provides a summary of all FDIC-insured institutions, the number of branches, the amount of deposits and the percentage of their market share for any specified geographic area (state, county, city, zip code). Multiple geographic components can be combined to create user defined custom markets (e.g. multiple counties, zip codes and cities).

Pro-Forma – The Pro Forma (HHI) Report offers the ability to see the before and after effects of proposed mergers or acquisitions within a specified geographic market. The results include the before (Old_Bank) and after (New_Bank) data with the summary of all FDIC-insured institutions within the geographic area as well as the number of branches, the amount of deposits, the market share and Herfindahl-Hirschman Index, HHI.

Market Presence – The Market Presence Report identifies where an institution operates geographically; by state, county or Metropolitan Statistical Area (MSA), in a single report.

Growth Rate – The Growth Rate Report provides the ability to compare two years of data for any FDIC-insured institution or bank holding company by state, county or MSA.

National Credit Union Administration (NCUA)

About NCUA – Overview

- Mission & Vision

- Leadership

- Board Actions

- Inspector General

- History

- Open Government

- Budget and Strategic Planning

- Federal Credit Union Act

- Privacy

- Business Opportunities

- No Fear Act

- Contact Us

- Whistleblower

Services – Overview

- Credit Union Resources and Expansion

- Unclaimed Deposits

- Freedom of Information Act

- Order Publications

- Fraud Hotline

- Share Insurance Fund

- Central Liquidity Facility

- Closed Credit Unions

Consumers – Overview

- Financial Literacy Resources

- MyCreditUnion.gov

- Pocket Cents

- Consumer Assistance Center

- Share Insurance Coverage

Credit Union Analysis – Overview

Regulation and Supervison – Overview

News and Publications

National Organizations

Regulatory

- Consumer Financial Protection Bureau (CFPB)

- Federal Deposit Insurance Corporation (FDIC)

- Federal Financial Institution Examinations Council (FFIEC)

- Federal Reserve Bank (FRB)

- Federal Reserve Bank of Kansas City (FRB-KC)

- Office of the Comptroller of the Currency (OCC)

State Organizations

Kansas

Missouri

Opportunity Zones

Department of Economic Development – Opportunity Zones

Maps of Tracts Accepted by Missouri Department of Economic Development:

Cluster Maps:

- Kansas City, Missouri Clusters

- Central City Cluster

- 353 Cluster

- EEZ Cluster

- LCRA Cluster

- New Market Tax Credits (NMTC) Cluster

- Blue Valley Cluster Focus

- Central City Cluster Focus

- Martin City Cluster Focus

- Paseo Cluster Focus

- Swope Park Cluster Focus

- Green Impact Cluster Focus

- Non-Residential Additions/Alternations

- Non-Residential New Construction

Order Free Handouts

Locating Public Evaluations

FFIEC – This search engine will enable you to find the latest CRA ratings of financial institutions supervised by the Federal Reserve, Office of the Comptroller of the Currency, Federal Deposit Insurance Corporation, and/or Office of Thrift Supervision.

FDIC – These pages enable you to find current and past CRA ratings and PEs for specific institutions that have been examined by the FDIC since July 1, 1990. The site offers users the opportunity to search for the ratings and PEs of one or more institutions.

FRB – The database here provides ratings information dating back to 1990 for banks examined by the Federal Reserve. Ratings can be reviewed for a particular group of banks or for a single bank.

OCC – Search national bank CRA ratings and performance evaluations and get lists of banks examined for CRA compliance.

Public School Review

Provides information on public schools in all 50 states and some private schools too. Data primarily describes academic performance, expenditure per student, student-teacher ratios, graduation rates, ect. It also includes percentage of students eligible for the USDA free- and reduced-priced meals program.

Regulator Resources

National Organizations

Regulatory

Federal Deposit Insurance Corporation (FDIC) Links

- FDIC

- FDIC Financial Institution Letters

- FDIC Risk Management Manual

- Call Report Forms/Instructions

- FDIC Industry Analysis

- FDIC Quick Links and Quarterly Profile

Federal Reserve Bank (FRB) Links

- Federal Reserve Bank of KC

- Federal Reserve Bank Information and Regulations

- Federal Reserve Compliance Guide

- Federal Reserve “Ask the Fed” Program

- 10th District Beige Book

Office of the Comptroller of the Currency (OCC) Links

Federal Financial Institution Examinations Council (FFIEC) Links

- FFIEC Home Page / UBPR Data

- FFIEC / UBPR Users Guide and Technical Information

- FFIEC IT Handbook Infobase

Consumer Financial Protection Bureau (CFPB) Links

- CFPB Consumer Tools

- CFPB Practitioner Resources

- CFPB Data & Research

- CFPB Policy & Compliance

- CFPB About Us

Financial Crimes Enforcement Network (FinCEN) Links

NMLS Resource Center

- State Regulator Websites (via NMLS)

- American Association of Residential Mortgage Regulators (AARMR)

- National Association of Consumer Credit Administrators (NACCA)

- Federal Agency Contacts

- Conference of State Bank Supervisors (CSBS)

State Organizations

Missouri

Kansas

Rural Community Development

USDA Economic and Rural Development

National Rural Housing Commission

National Low-income housing commission

Small Business/Entrepreneurship

Visit the following Money Smart Topics for helpful information and links.

Entrepreneurship

Learn about starting, running and growing a small business. Find mentors or network with other business owners.

Unbanked Survey

Banking the Unbanked and Underbanked

Although the unbanked population decreased from 12.1% in 2013 to 5.0% in 2015, there are tens of thousands of unbanked families in the Kansas City Metropolitan Statistical Area (MSA) and hundreds of thousands of unbanked families.

The Alliance for Economic Inclusion and Money Smart KC work with over 1,000 partnering organizations to stabilize families, financially educate families, bank families and promote economic mobility with all family members.

To better understand the unbanked and underbanked populations in the Kansas City MSA, please visit https://www.economicinclusion.gov/.

Economic Inclusion Surveys & Data