Loans

Access to loans can be helpful for covering expenses, making a large purchase, starting a business, or for the cost of continuing education. Several types of loans are available and each can offer an avenue to purchase items that you wouldn’t have access to otherwise.

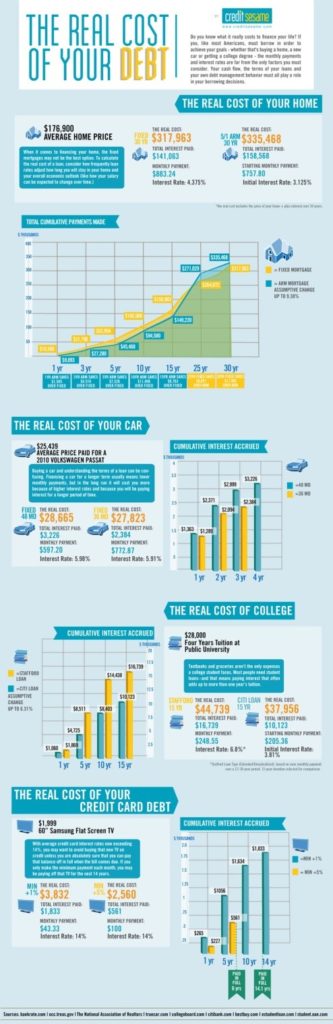

It is important to know the facts about the various types of loans and the true cost of borrowing.

What Loan Is Best For You?

Types of Loans

Auto Loans

Whether you’re buying your first automobile, or replacing an existing one, there are numerous ways you can be sure you’re not overpaying, and you’re getting an auto loan that fits within your budget.

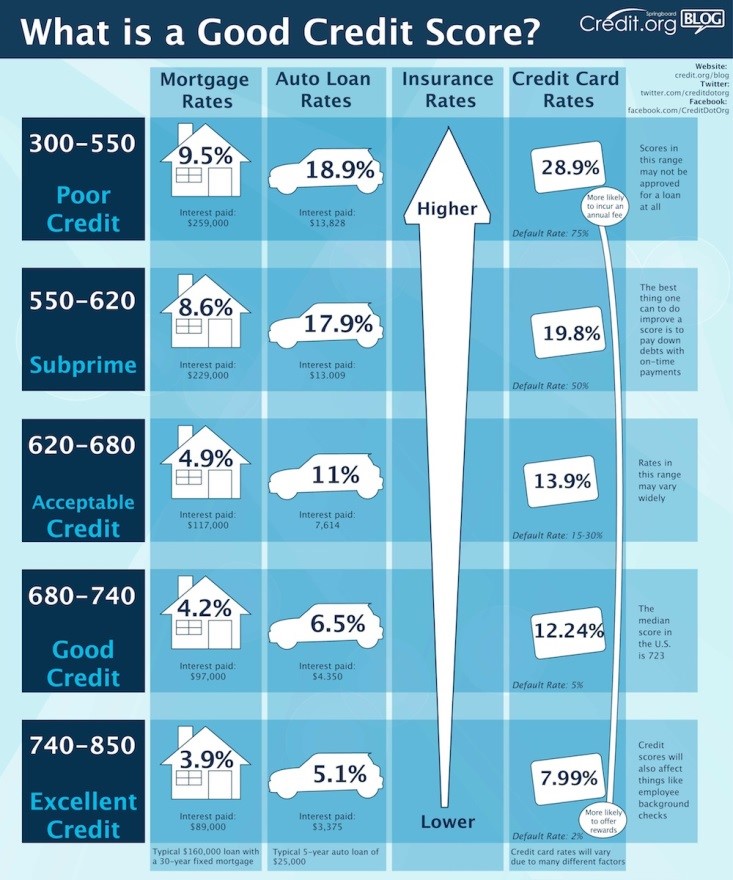

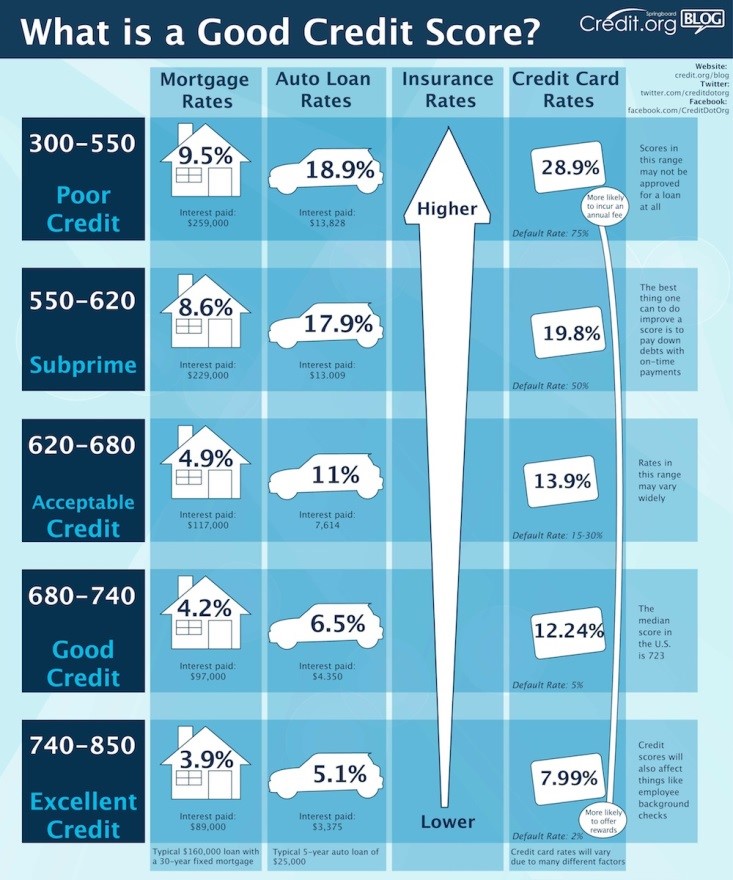

Image to right found on www.credit.org

Compare Auto Loans

Check new and used automobile values

- Edmunds Online Car Appraisal

- Kelley Blue Book Auto Value Calculator

- NADA (National Automobile Dealers Association) Auto Value Calculator

Choosing a Car

Choosing an Auto Loan

- Consumer Financial Protection Bureau, “Know Before You Owe”

- Understanding Vehicle Financing from the FTC

- CFPB (Consumer Financial Protection Bureau) Auto Loan Shopping Sheet

- Co-signing a Loan from the FTC

Auto Loan Calculator

Auto Service Contracts and Warranties

- Auto Service Contracts and Warranties from the FTC

- Credit Insurance, What to Know from the FTC

- Avoiding Service Contract and Warranty Scams from the Federal Communications Commission

When to Refinance, and Refinance Calculator

For more information on credit, visit: MSKC Credit Topic and MSKC Credit Reports and Scores

Student Loans

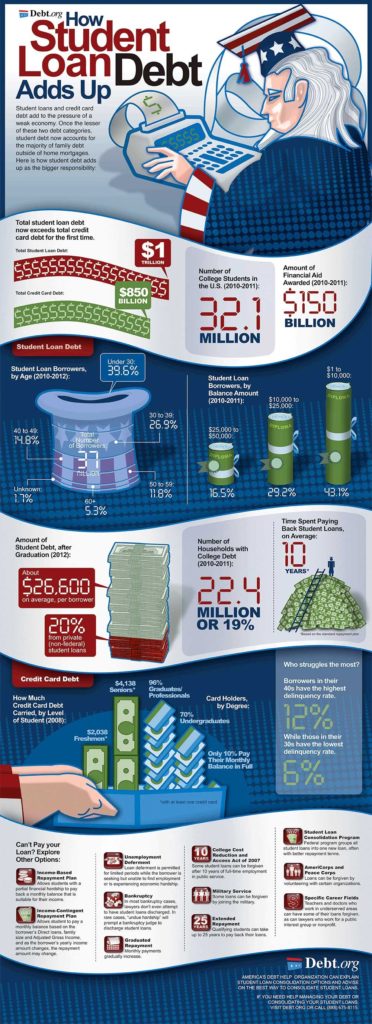

Image on right found on (www.debt.org)

Find information for student loans at www.studentloans.gov

- Undergraduate students

- Graduate/professional students

- Parent borrowers

- Repayment and consolidation

- Contact us

Resources for student loans

- Loans

- Federal Loans

- Direct Subsidized – Loan that does not accrue interest during enrollment for undergrad students based on financial need

- Direct Unsubsidized – Loan for undergrad, grad and professional students

- Direct PLUS – Loan for grad and professional students and parents of dependent undergrads to pay for costs above and beyond financial aid

- Direct Consolidation – Loan that enables borrowers to combine federal student loans into one single loan

- Federal Loan Comparison PDF

- Learn about current limits per loan

- CFPB Paying for College Action Guide – PDF – Tips for finding a loan that’s right for you

Related Topics

Credit Cards

Understand credit cards at usa.gov/credit-cards

- Choose a credit card

- Credit card laws

- Credit card protection

- Credit card resources

- Consumer Financial Protection Bureau (CFPB) – Provides a list of credit card companies that provide their customers with free and ready access to their credit scores.

Cash Advance

- The High Price Of Cash-Advance Convenience Checks – CreditCards.com

- What Are Credit Card Convenience Checks – Rates, Fees, Pros & Cons – Money Crashers

- What Is A Credit Card Cash Advance? – Bank of America

Balance Transfer

- What You Need To Know About Balance-Transfer Credit Card Offers – USA Today

- Balance Transfers 101 – CreditCards.com

- How To Get The Most From A Balance Transfer – Bank of America

- How To Save Money With A Balance Transfer – The Simple Dollar

Credit Card Comparison Sites

Credit Card Calculators

Home Loans / Mortgages

Home loans include first mortgages, 2nd mortgages, home equity lines of credit, reverse mortgages and are available in a variety of rates, terms and qualifying criteria.

Compare Mortgage Loans

Types of Home Loans:

- VA (Veterans Administration) Loans

- Federal Housing Administration (FHA) Loans

- Conventional Loans (Bankrate.com)

- Home Equity Line of Credit (Bankrate.com)

- Reverse Mortgages (Federal Trade Commission-FTC)

Home Loan Calculators

- How much house can I afford? (Bankrate.com)

- Mortgage Prequalification Calculator (Bankrate.com)

- Mortgage Calculators (Bankrate.com)

- Refinance Calculator (Bankrate.com)

Becoming Mortgage Ready

Down Payment Assistance Programs

- MHDC Missouri Housing Development Commission

- CHIP Community Housing Investment Partnership from the WYCOKCK.org

Avoiding Mortgage and Home Loan Scams

Personal Loans

Personal loans are typically unsecured, meaning they don’t require something of value as collateral like a car or house to secure the loan. However, personal loans differ from short-term payday loans in that repayment can be structured over a much longer period of time, and include a significantly lower rate of interest. Additionally, lenders making personal loans will usually look at credit and ability to repay as criteria for approving a personal loan.

- To find out more, visit: FTC Information on Credit & Loans

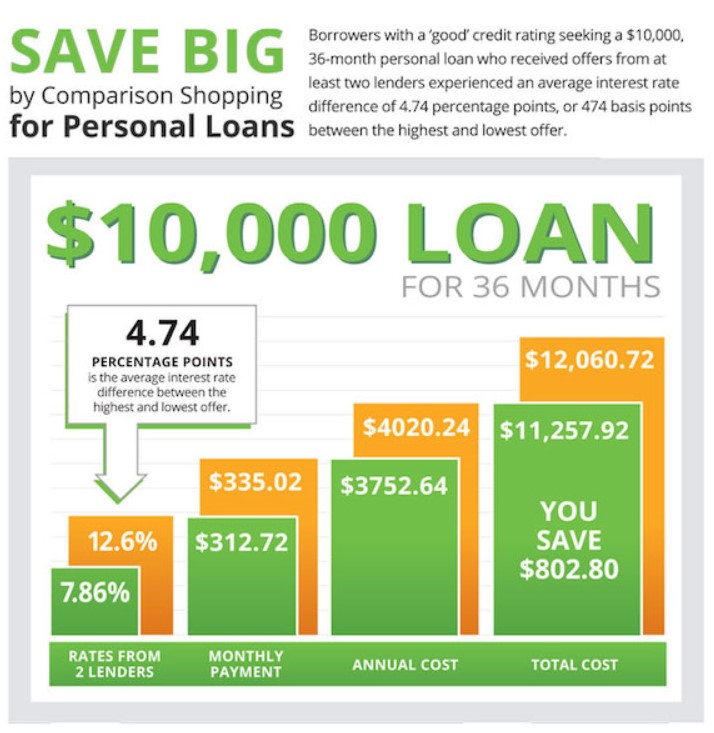

Comparing Personal Loans

- Consumer advocate comparison of 2016 personal loans

- Bankrate personal loan comparison

- Lending Tree personal loan comparison

Avoiding Loan Scams

- Sure signs of loan scams from the Federal Trade Commission (FTC)

What You Should Know Before Co-signing a Loan

- Co-signing a loan from the FTC

Credit Insurance

- What you should know about credit insurance from the FTC

For more information on credit, visit: MSKC Credit Topic and MSKC Credit Reports and Scores

Small Business Loans

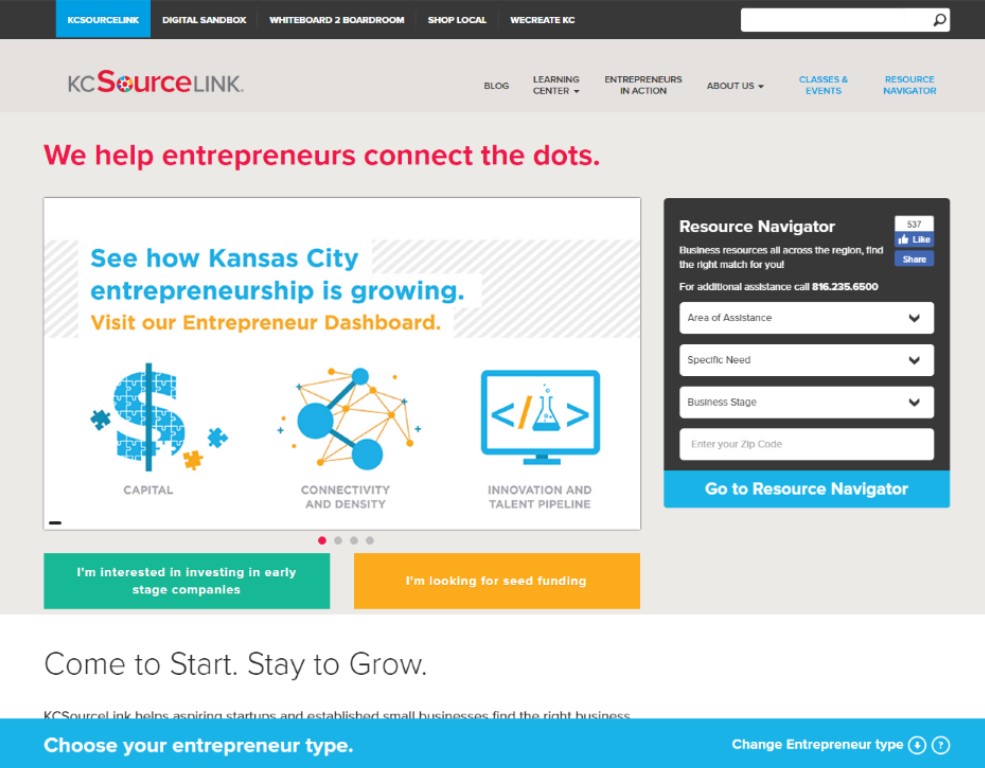

Find Small Business Funding at KCSourceLink

- Determine how much money you need to start a business.

- Find free, confidential financial advice for your business.

- Get access to business financial classes and events.

- Learn about your business funding options.

- Decide which funding options are best for you

Need Help? Call KCSourceLink: 816-235-6500 or 866-870-6500, visit KCSourceLink website or via email: Contact Us

Retirement Plan Loans

Retirement Plan Loans

- 401(k)

- 403(b)

- 457(b)

Ask your employer or review the summary plan description.

IRAs and IRA-based plans (SEP, SIMPLE IRA and SARSEP plans) cannot offer participant loans.

Loans must meet certain requirements. The employee should review information from the plan administrator outlining terms for obtaining a loan.

Retirement Plan Loans FAQ’s (IRS)

This section provides the user with information responsive to general inquiries. These answers do not apply to every situation. Please contact a professional for more information.

Hardships, Early Withdrawals and Loans

Mostly, a retirement plan can distribute benefits only when certain events occur. Your plan should clearly state when a distribution can be recieved. The plan document and summary description will also state whether the plan permits hardship distributions, early withdrawals or loans from your account.

Types of Retirement Plans

Benefits distributed from a retirement plan are based on:

- The distribution available under the plan

- Elections choices by plan participants and their stated beneficiaries.

Resources about retirement plan loans

- 4 Reasons To Take Out A (401)K Loan – Bankrate

- Should You Borrow From Your Retirement Plan – Investopia

- 5 Reasons To Be Cautious About (401)K Loans – Fidelity

- Should You Borrow Money From Your (401)K – The Motley Fool

- What You Need To Know Before Borrowing From Your (401)K – My Retirement Paycheck

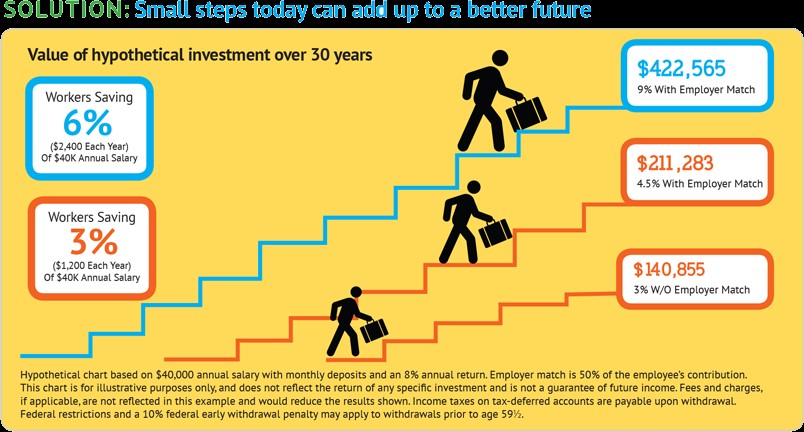

Retirement Calculators

Payday & Title Loans

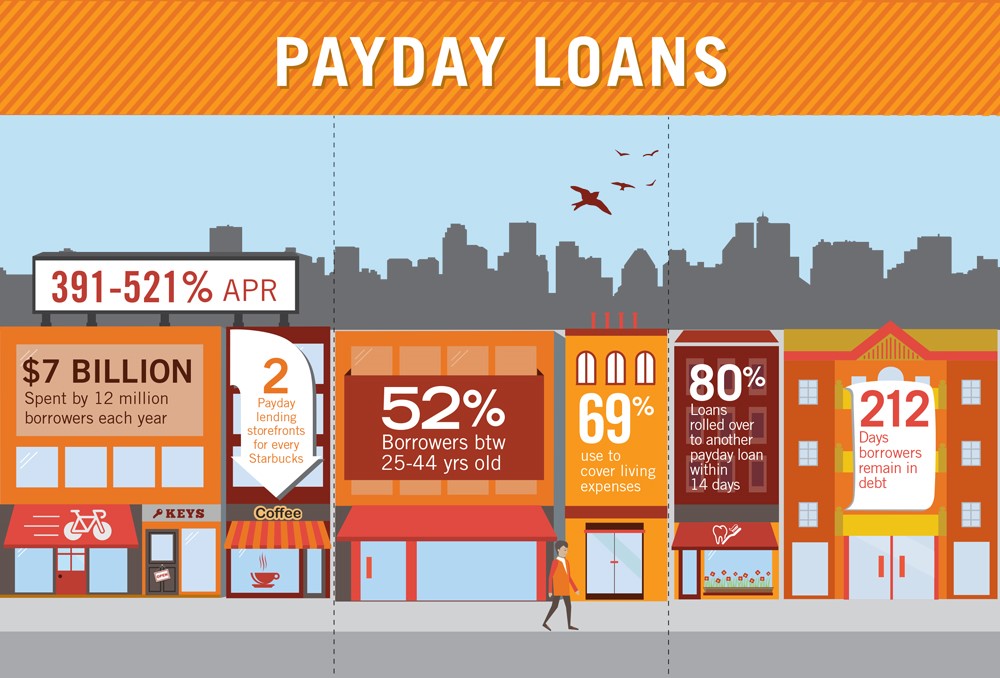

Payday loans are unsecured, short-term, “paycheck advance” loans, typically between $100 & $1,000 with full balance (plus interest) due dates, on average, of 14 days. While some states regulate the maximum amount of interest short-term lenders may charge, the national average comes out to about 400% APR, compared to a typical credit card where the rate is between 12 and 30 percent. The combination of high interest and short repayment time create what is commonly known as the payday lending cycle, whereas a borrower must re-borrow at each due date, creating a long-term problem for what was intended to be a short-term fix. Fortunately, there are a growing number of alternative lending resources developed to help borrowers avoid the cycle. Coming soon – we’ll list some local resources for alternative lending(some are through partners and employers).

- The Consumer Financial Protection Bureau (CFPB) offers extensive information on payday loans.

- Also visit Payday Loan Consumer Information, a state by state guide regarding short-term lending guidelines.

- Title loans are another form of short-term, high cost loan products. Find out more here: Car Title Loans, What You Need to Know

Graphic courtesy of Accion.org

Get A Financial Coach

Although eight separate loan categories are presented to give information on multiple loan topics, we still suggest that you talk with a financial coach before making any borrowing decision. Many non-profit organization concentrate efforts on financial coaching and credit counseling. You can meet with a counselor in a free, initial counseling session that sets the foundation for identifying what you want to accomplish, including solutions to credit and debt concerns.

Understanding Credit

Before applying for any loan, you need to know your credit. Money Smart KC has two topics on credit that can help you.

Encourage a banking relationship or the benefits of banking

Visit the following Money Smart Topics for helpful information and links.

Banking 101

When managing your money, the right tools can make all the difference. Learn the basics of banking and be on your way to reach your financial goals.